Powerful insights into leadership and sustainability

PhD., awarded thought leader, founder of Profitable Green Solutions on a mission to make sustainability more attractive

Request fees and availabilitySend a simple request. You’ll get a quick reply with fees and availability

Biography

Keynote

Articles

Keynote speaker Eric Woodroof, PhD., has trained thousands of professionals, leading to billions in savings on energy expenses AND global pollution. His insights are highly respected, earning him US Department of Energy Awards as well as the Lohmann medal. What’s more, he earned a spot as the youngest member inducted into the Association of Energy Engineers’ Hall of Fame!

Since founding Profitable Green Solutions (PGS) in 1995, Dr. Woodroof has both identified and developed energy projects. In particular projects which are financially attractive, thereby making it attractive and more cost-competitive for businesses to go “green”.

Dr. Woodroof openly shares his best practices through books, articles and other media. In addition, he has created certifications and training programs which are endorsed by countries on 6 continents! A sought-after thought leader, speaker Eric Woodroof, PhD., has even represented the green energy industry in discussions with former US presidents and other leaders.

Dr. Woodroof also served as President of the Association of Energy Engineers, which has over 19,000 members in over 90 countries. He has served on several certification boards and editorial boards before becoming the Chairman of the Energy Management Professional Council.

See keynotes with Dr. Eric Woodroof

In this talk you will learn how to prepare for trends that are affecting the Energy/Sustainability/Utility Marketplace.

Learn about Interesting Insights, Backstage “aha”s and Success Philosophies from US Presidents and Leaders. Dr. Woodroof has direct experience working with former US presidents.

Speaker Eric Woodroof, PhD. can speak from several angles on how to sell Energy/Sustainability Projects.

EE Beats Wall Street

Many of us have seen greater returns on our 401K accounts and other stocks during the past 2 years. However, no one can guarantee that such performance is going to continue. In fact – the stock market could drop suddenly and there is little you could do about it.

We have zero control over Wall Street’s performance. Beyond that fact, a typical energy project (in which you do have some control) is a better investment anyway! The example below compares the Dow Jones Index’s performance for the past 10 years versus a typical energy efficiency project that yielded a conservative 5-year simple payback (or 20% Return on Investment), which is easy to find.

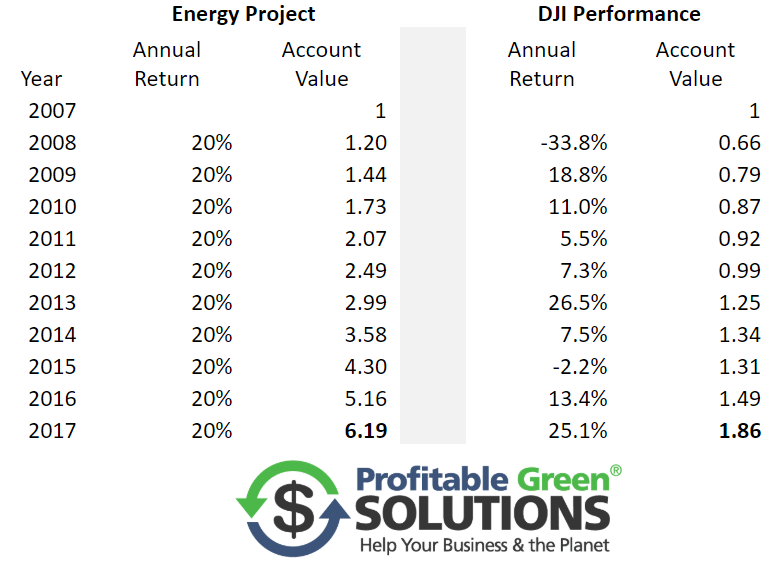

Here is the year by year comparison of value if you invested $1 and then re-invested the gains each year (either into additional energy projects or the Wall Street Fund):

At the end of 10 years, the Energy Project would have yielded $6.19 for every dollar invested (net gain of $5.19), while the DJI would have yielded only $1.86 for every dollar (net gain of $0.86).

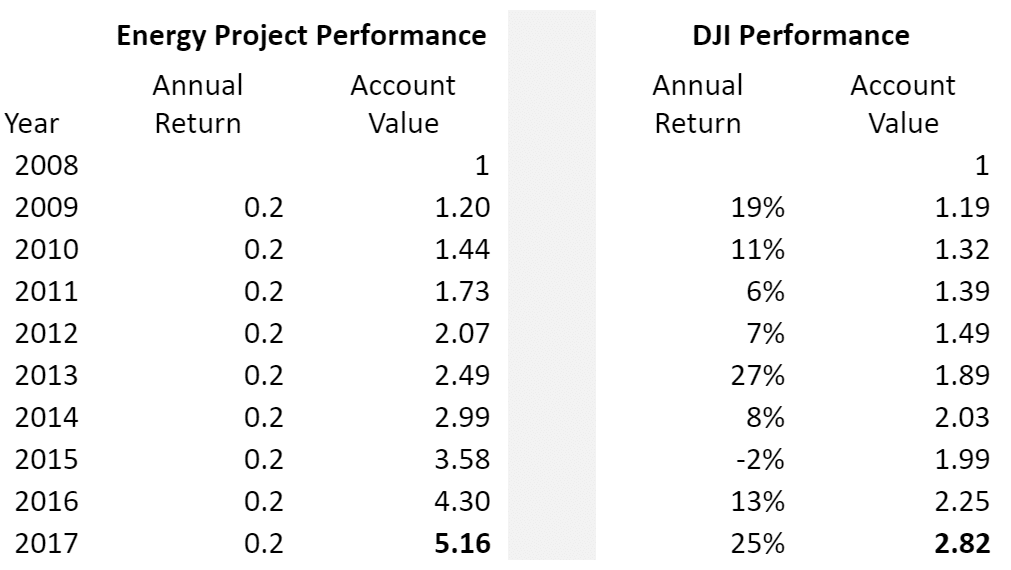

Suppose we consider an alternative comparison and we remove the year 2008, because that was a “bad year” for Wall Street. In this case (below) the Energy Project would still have yielded $5.16 for every dollar invested (net gain of $4.16), while the DJI would have yielded only $2.82 for every dollar (net gain of $1.82).

If you look objectively at the data… Energy Projects beat Wall Street overall and they beat Wall Street in 8 out of the last 10 years… and we aren’t even accounting for the fact that most EE projects carry very little risk!

Additional Considerations

To be fair- perhaps your company has projects or business processes that return greater than 20%. In that case- great! You should put your money there… but don’t forget to ask if those non-energy projects will get those returns every single year… because the energy projects will.

In fact- energy projects will likely save additional monies as utility prices fluctuate. In addition, by using less energy, your company is less vulnerable to utility price spikes.

As I have written about in past articles, you could also present the savings as “avoided costs”, such that if you didn’t do the energy project, you would be “throwing away” the net benefit ($5.19) on wasted energy bills.

You could also relate back to research I did about 20 years ago, which shows that a company’s stock price increases significantly (by 21% above market) when that company announces an energy project. That study was done with a confidence interval of 95%, and your company’s CFO may be very interested in reading that paper.

Conclusion

I want to restate that when comparing “apples to apples” investment-wise, the low-risk Energy Efficiency Projects perform better than Wall Street Investments.

The youngest member of 2 Halls of Fame. Speaker Eric Woodroof, PhD., is an award winning engineer, advancing energy sustainability all over the world for over 2 decades.

What got you interested in energy management?

While watching “Dances with Wolves”, I wanted to do something that “helped” our environment. After wars… energy consumption has had the most destructive impact on our planet… so it seemed like a problem worth devoting my life to.

How have things changed since you started working with energy management?

The “information age” and renewable energy advancements have made for cleaner energy production, yet there is still a long way to go… but at least more people are aware of the problem.

What does sustainability mean to you?

Providing the needs of today… without sacrificing tomorrow.

What are your biggest goals in your life/career currently?

I would like to see more energy efficiency/conservation projects get done… when people understand how easy it is, they are better able to take action. Most projects have financial returns that are 2-3 times better than Wall Street… and have less volatility!

Who is your role model?

Al Gore has done a lot to share climate data, and for little economic gain… I find that admirable.

How much does humor factor into your keynotes and other speaking engagements?

Humor is a critical “ice breaker” on these difficult topics/challenges. Often in talks, I will engage an audience with humor, then depress them with the data… but then lift them up by showing how they can be a part of the solution… but humor throughout the journey keeps them listening.

Send a simple request. You’ll get a quick reply with fees and availability