5.00 of 5

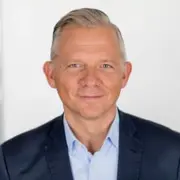

Top rated!Matthias Kroener

5 of 5

“Matthias is one of the most inspiring disruptors and thought leaders in the industry I ever met.”

Brett King

Banking Futurist

5.00 of 5

Top rated!5 of 5

“Matthias is one of the most inspiring disruptors and thought leaders in the industry I ever met.”

Brett King

Banking Futurist

5 of 5

“Matthias is one of the most inspiring disruptors and thought leaders in the industry I ever met.”

Brett King Banking Futurist

5 of 5

“Great presentation today by Matthias Kroener, highlighting fintech approach vs. incumbents strategy – and its huge conflict.”

Susanne Chrishti CEO FINTECH Circle & FINTECH Circle Institute, Investor

5 of 5

“Unfortunately, I always felt constantly caught during Matthias ́ Murder and Assassination talk at Money2020, being a representative of an incumbent player, in charge for strategic growth development and M&A.”

Holger Ziegler Director Strategy and Corporate Development

5 of 5

“Fantastic murders and assassinations presentation. Possibly my favourite of the whole conference. It’s always good when you go to conferences and speakers are discussing real life experiences rather than reading from a corporate script. I think that helps everyone.”

Sophia Furber Reporter, European banking and fintech at S&P Global Market Intelligence

keynote by Matthias Kroener:

Keynote by Matthias Kroener:

Keynote by Matthias Kroener:

Keynote by Matthias Kroener:

Keynote by Matthias Kroener: